Investment Surge and Industry Growth

Offshore gas production in Southeast Asia is on the cusp of a dramatic expansion, with a potential $100 billion investment boom projected by 2028, according to Rystad Energy.

This surge represents a significant increase compared to the $45 billion invested between 2014 and 2023, signaling a transformative period for the region’s offshore gas industry.

Key Drivers of Growth

Several factors are fueling this growth, including a wave of planned final investment decisions (FIDs), a focus on deepwater projects, recent promising discoveries in Indonesia and Malaysia, and advancements in carbon capture and storage (CCS) technology.

Investment Landscape and Industry Players

Oil and gas majors are expected to lead 25% of these investments by 2028, while national oil companies (NOCs) are projected to account for 31%.

Notably, East Asian upstream companies are gaining traction with a 15% share, driven by mergers and acquisitions (M&A) and exploration activities.

TotalEnergies’ recent acquisition in Malaysia could further elevate the majors’ share to 27%.

Balancing Energy Security and Sustainability

Southeast Asian nations are increasingly prioritizing energy security and the transition to gas as a fuel.

To address the energy trilemma of balancing energy security, energy equity, and environmental sustainability, countries are focusing on utilizing domestic gas resources while implementing policies and incentives that promote sustainable practices and enhance regional energy security.

Challenges and Solutions

While the outlook for offshore gas development is promising, project delays remain a concern.

Deepwater and sour gas economics, infrastructure readiness, and regional politics have all contributed to delays, some spanning over two decades.

However, the emergence of CCS hubs in Malaysia and Indonesia offers a potential solution.

The high carbon dioxide (CO2) content in upcoming projects necessitates CCS for financing and regulatory compliance.

Both countries are also exploring depleted reservoirs for CO2 storage, further driving demand for this technology and accelerating offshore gas development.

Investment Trends and Future Outlook

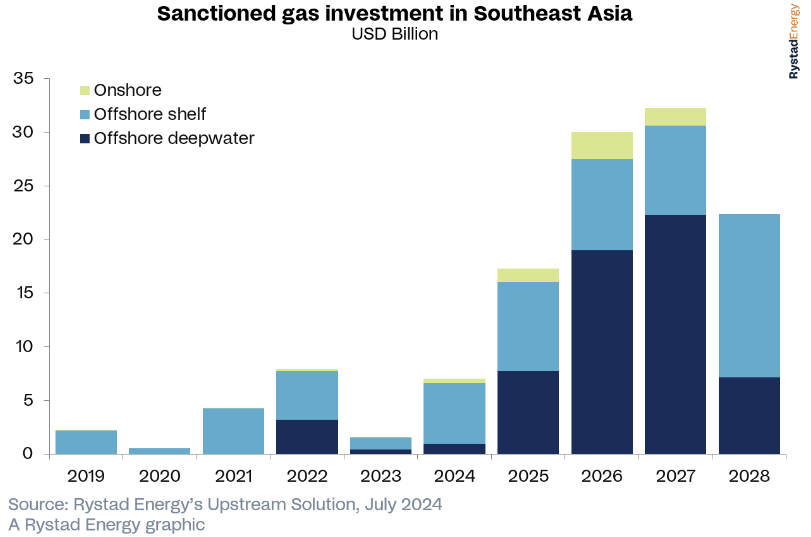

Investment in new projects and capital commitments have surged in the region, from $9.5 billion in 2022-2023 to an estimated $30 billion in 2024-2025.

This upward trajectory is expected to continue through 2028, driven by recent discoveries and NOC involvement, particularly in deepwater projects.

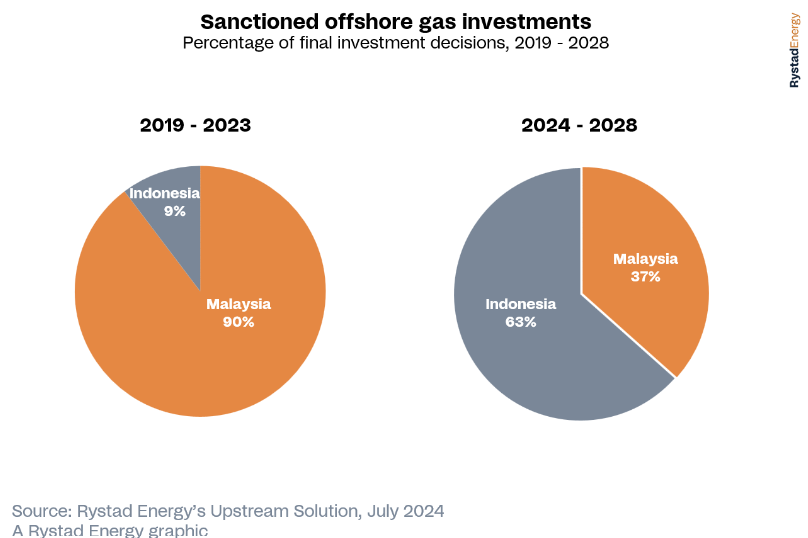

Indonesia and Malaysia: Leaders in Offshore Gas Development

Indonesia, with major projects like the Inpex-operated Abadi LNG, Eni’s Indonesia Deepwater Development (IDD), and BP’s Tangguh Ubadari Carbon Capture (UCC), is poised to ramp up its offshore gas activities.

Malaysia, while maintaining robust activity levels, also has a strong pipeline of FID projects driven by recent discoveries.

Economic Viability and Gas Pricing

The region’s gas sector is projected to experience substantial growth, with gas resources from FIDs expected to triple by 2028.

However, operators face economic challenges, especially in deepwater and sour gas projects.

Many projects require gas prices above historical averages of $4 per thousand cubic feet to be profitable, ideally closer to $6.

This has led to discussions on revising domestic gas pricing policies, as a price of $7.5 per thousand cubic feet could make up to 95% of planned developments economically viable.

Conclusion

Despite economic hurdles, the outlook for Southeast Asia’s offshore gas sector is positive.

The region’s vast gas resources, coupled with technological advancements like CCS and strategic investments, are positioning Southeast Asia for a significant gas boom in the coming years.