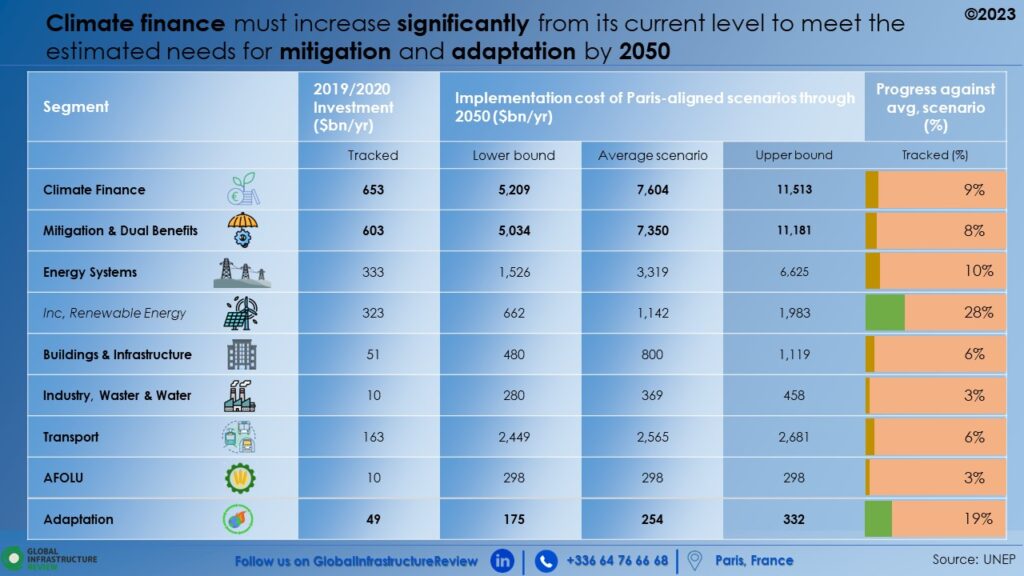

In recent years, efforts in climate finance have been observed with an average of $653 billion per year allocated in 2019/2020. With regard to mitigation financing, the following points are observed:

– Mitigation finance still accounts for a significant share of climate finance (~90%) and has almost doubled in the last decade, with a CAGR of over 7%.

– Top sectors for mitigation are renewable energy production ($323/Yr on average) and development of low carbon transport ($163/Yr on average).

– A funding gap is noticeable in end-use segments such as industry, water and waste and AFOLU over the period (only 2% of mitigation funds allocated).

– Energy efficiency, which is expected to play an important role in many Net zero trajectories, remains relatively small compared to other sectors ($51 billion on average in 2019/2020).

In addition to financing mitigation measures, massive investment in capital assets and enabling infrastructure is needed.

What is important to consider when talking about the transition to net zero is the allocation of capital as net-zero targets involve a shift in demand for infrastructure, land-use and energy systems.

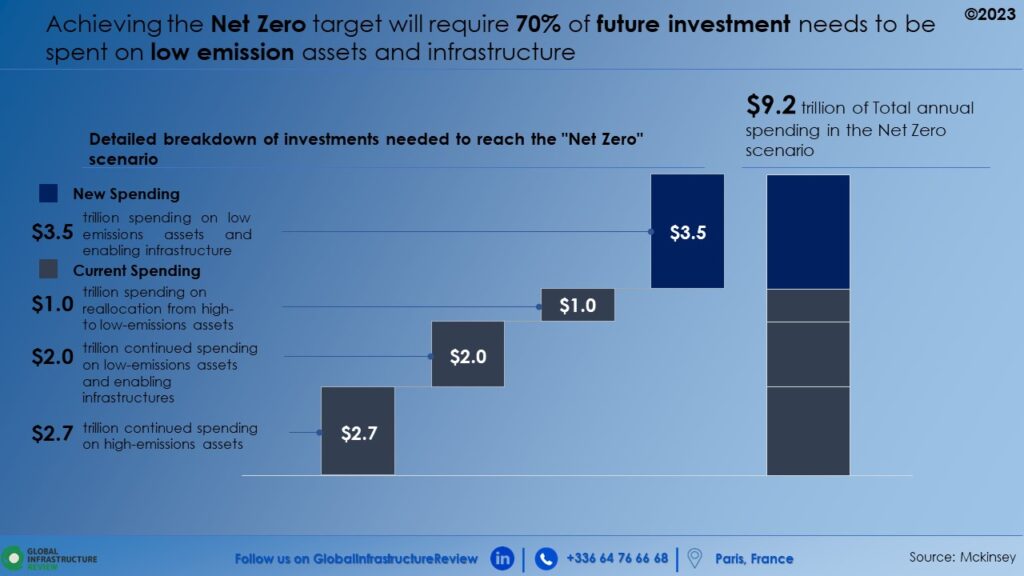

Mckinsey analysis has shown that in the NGFS net zero scenario, almost $9.2 trillion per year would be required by 2050.

This amount includes funding for new physical assets and decarbonisation of existing assets, with the following breakdown

– New spending on low-emission assets (energy and land-use systems) of $3.5 trillion will be needed each year, equivalent to 2.8% of global GDP.

– A reallocation of $1 trillion/Yr from current spending on high-emissions to low-emissions assets.

– Current spending of $2 trillion/Yr on low-emission assets in sectors such as mobility, energy and buildings will continue to be needed.

– 30% of the $9.2 trillion in total spending will continue to be on high-emissions assets.

It is important to remember that today 65% of total spending ($3.7 trillion out of $6.7 trillion) is allocated to high-emissions assets, but we need to reverse this trend by 2050 by allocating only 30% of total spending to high-emissions assets, with the remaining 70% allocated to low-emissions assets.

To reach this goal and close the financing gaps, as mentioned by David Carlin it will be important to create the right market incentives by developing carbon pricing and taxation mechanisms. Development finance, the private sector and governments will also have an important role to play.