In 2023, the global demand for critical minerals and metals saw a significant increase: +30% for lithium (mainly for electric vehicle batteries), +8% to 15% for nickel, cobalt, graphite, rare earths, and more.

“The global appetite for solar panels, electric vehicles, and batteries is growing rapidly, but we cannot meet it without a reliable and increasing supply of minerals and metals (copper, lithium, nickel, cobalt, rare earths),” emphasized Fatih Birol, director of the International Energy Agency (IEA), on the occasion of the release of a new report on May 17.

The rise in the number of electric vehicles sold worldwide in 2023 (nearly 14 million, up 35% from 2022) partly explains these growing needs, along with significant expansions in wind and solar capacity and the extension of electrical grids.

In its “STEPS” scenario, based on current policies, the IEA predicts that global demand for critical minerals and metals will double by 2030. In its “NZE” scenario (aiming for carbon neutrality by 2050), these needs are expected to triple by 2030 and quadruple by 2040.

Lithium, central to electromobility development, could experience even stronger growth, with global demand projected to increase ninefold by 2040 according to IEA projections (still in its “NZE” scenario).

Unstable Markets

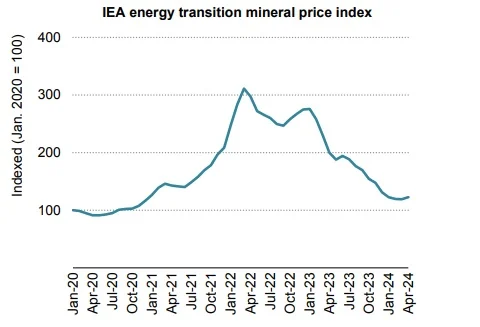

Critical minerals and metals markets remain unstable, with a significant price drop in 2023 (-75% for lithium) following two years of sharp increases. The Energy Transition Mineral Price Index by the IEA, which tracks the prices of various critical metals, tripled in the two years following January 2020 before returning almost to its initial level by late 2023.

Substantial production growth, particularly in Africa, Indonesia, and China, attributes the price decline, despite the demand surge.

The Agency estimates the current market value of various key minerals and metals for energy transition at nearly $325 billion (approximately equivalent to the iron ore market). By 2040, this value could more than double to reach $770 billion according to the IEA’s “NZE” scenario.

Impact on Investments

The drop in prices of minerals and metals crucial for the energy transition is a “double-edged sword – a boon for clean energy deployment but a bane for investments in critical minerals and their diversification.”

In 2023, these investments increased by “only” 10% amidst price declines. According to IEA estimates, nearly $800 billion in investments in extracting these key resources would be necessary by 2040 (with $492 billion for copper alone) to stay on track with a “+1.5°C” scenario.

Innovation, material recycling, and behavioral changes are expected to alleviate tensions in the supply chain (while also diversifying sources and ensuring exploitation is as “clean and responsible” as possible).

To find out more, read the IEA report.