Energy transition coupled with the energy crisis characterised by rising fossil fuel prices is redefining the investment environment for start-ups.

An unprecedented situation has been observed in recent months in terms of global investment by venture capital firms.

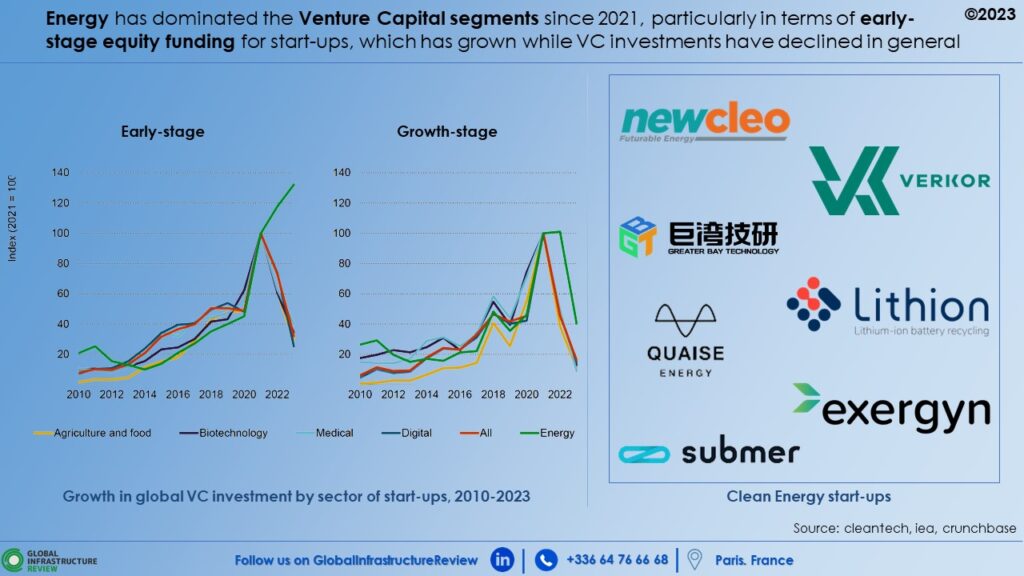

Among start-ups in different tech sectors such as agriculture and food, biotechnology, medicine, digital and energy, the clean energy sector has shown the best score in terms of growth in venture capital investment both in the early stage and in the growth stage (although less pronounced).

According to the IEA’s World Energy Investment Report, 2022 was the most important year to date for equity financing for start-ups in the energy sector.

Start-ups specialising in CO2 capture, nuclear, renewables and energy efficiency saw their 2021 funding levels almost double in 2022.

The report highlights that venture capital funding could continue to increase in 2023 for early-stage start-ups, with clean energy taking the largest share, reflecting investor confidence in energy transitions.

The situation is different for start-ups in the growth stage, as they need more capital. Indeed, after increasing by 1% in 2022, growth-stage funding was very weak in the first quarter of 2023 and could fall by almost 60% in 2023 due to unfavourable macroeconomic conditions.

Clean mobility, renewables, energy storage and energy efficiency continue to attract more equity funding for energy startups, with over 55% of investment directed to US-based startups. Growing policy and fiscal supports through important measures such as the US Inflation Reduction Act has contributed to these results.

The data collected showed that start-ups working on improving hardware technologies, in particular electric vehicles, nuclear, geothermal, heating and cooling start-ups, captured around 75% of the funds allocated, with the remainder going to digital technology and the development of clean energy projects.

Finally, Start-ups such as Newcleo, a clean and safe nuclear technology company created in 2021 and working on the development of innovative generation IV reactors, were able to raise €300 million last year in the form of equity funds. Others, such as Greater Bay Technology, Verkor and Lithion Recycling, secured more than €100 million to support their activities.