Europe has emerged as the slowest-growing region for electric vehicle (EV) sales in the first half of 2024, as revealed by Rho Motion, a leading EV market research firm, in their mid-year update.

Global EV Sales Snapshot: January-June 2024 vs. January-June 2023

The global market saw just under seven million electric passenger cars and light-duty vehicles sold in the first half of 2024, marking a 20% increase compared to the same period in 2023.

Battery electric vehicles (BEVs) constituted 65% of global sales, with the remaining 35% attributed to plug-in hybrid electric vehicles (PHEVs).

- Global: 7.0 million in H1 2024, +20% y-o-y

- China: 4.1 million, +30%

- EU & EFTA & UK: 1.5 million, +1%

- USA & Canada: 0.8 million, +10%

- Rest of World: 0.6 million, +26%

Charles Lester, Lead EV Data Analyst at Rho Motion, commented on the regional disparities: “While the global EV market can find solace in the 20% growth observed in the first half of the year, the regional variations are noteworthy.

Europe’s 1% growth pales in comparison to China’s 30%, necessitating swift action to achieve Western targets. The resurgence of PHEVs, which had been losing popularity, is another unexpected development. They now account for over one-third of electric vehicles sold.

Overall, 2024 is unlikely to witness the ambitious growth anticipated by some, leading us to revise our forecasts downward by 5% to 16.6 million electric cars sold this year.”

EU & EFTA & UK: Mixed Results

The European market saw 1.5 million EV sales in the first half of 2024, a mere 1% increase compared to the same period in 2023.

Germany experienced a 9% decline, while France and the United Kingdom witnessed 8% and 13% growth, respectively.

Italy, despite setting a June 2024 sales record following the introduction of EV incentives, has seen an 11% decrease for the year so far.

China: Fastest Growth

China, with 4.1 million units sold compared to 3.2 million in the first half of 2023, has outpaced other major regions in EV sales growth. PHEVs have regained market share, increasing by 8 percentage points from 2023 to reach 41% in 2024.

This can be attributed to factors such as the expanding range of PHEVs offered by manufacturers, the growth of Range Extender Electric Vehicles (REEVs), and strong performance by BYD, which achieved record-breaking sales in June 2024.

USA & Canada: Positive Signs

The US & Canada EV market, after a slow start, showed encouraging signs in the second quarter. GM and Ford increased BEV sales by 34% and 18%, respectively, and Honda introduced new models. General Motors also ramped up production in Mexico.

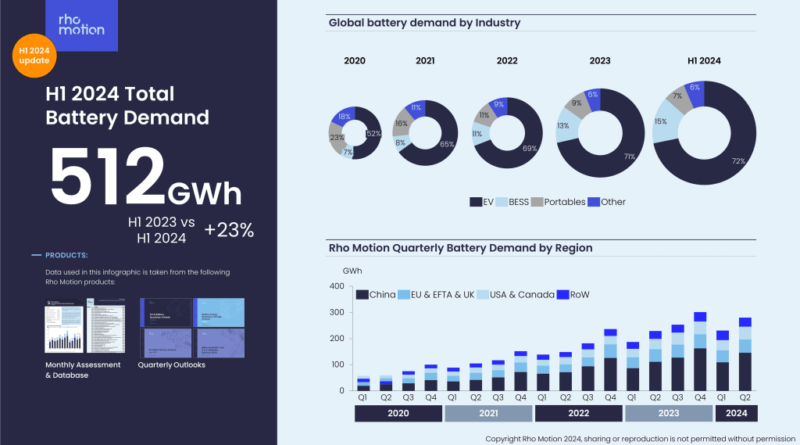

Battery Demand: H1 2024 Summary

Battery demand across all sectors exceeded 510GWh in H1 2024, a 23% increase from the previous year, according to Rho Motion. EV batteries accounted for 72% of this demand, while the stationary storage market witnessed the highest year-on-year growth, nearing 50%.

Iola Hughes, Head of Research at Rho Motion, highlighted the stationary storage market’s exceptional growth, driven by the increasing number and scale of projects. She also noted that the battery market is projected to surpass 1.2TWh by the end of the year.

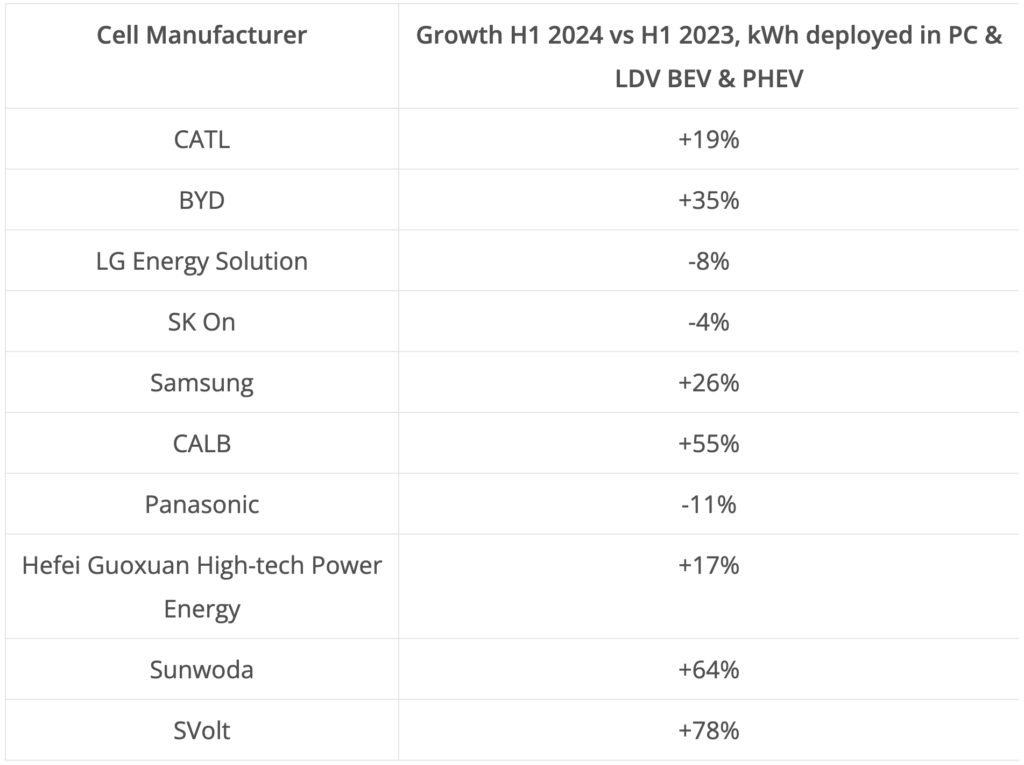

Battery Manufacturers: Uneven Landscape

The slowdown in EV sales has impacted cell manufacturers, with Chinese companies generally outperforming their Korean and Japanese counterparts.

LG Energy Solution, SK On, and Panasonic all saw declines in EV battery deployment compared to H1 2023. Concerns are mounting for some players, with SK On declaring a state of ’emergency management.’

Battery Technology: LFP and NCM Dominate

LFP (Lithium Iron Phosphate) continues to dominate the Chinese market, while NCM (Lithium nickel manganese cobalt oxides) remains prevalent outside China.

Newer technologies like LMFP and sodium-ion batteries, introduced in late 2023, are gradually gaining traction.

Stationary Storage: Significant Growth

Over 75GWh of new stationary storage capacity was added in H1 2024, surpassing the total for all of 2022. More than 500 grid-scale projects went live, with four exceeding 1GWh.

Ambitious plans are in place for 2024, with 18 projects over 1GWh slated for operation.

Looking Ahead: 2024 Battery Demand

For the full year 2024, battery demand is expected to grow by 20-25% compared to 2023, which marked the first year to exceed 1TWh. While the global EV market continues to expand, regional growth patterns and the performance of battery manufacturers remain uneven.