The alarming increase in ghg emissions, which reached 59 metric gigatonnes in 2019, poses a serious threat to the planet.

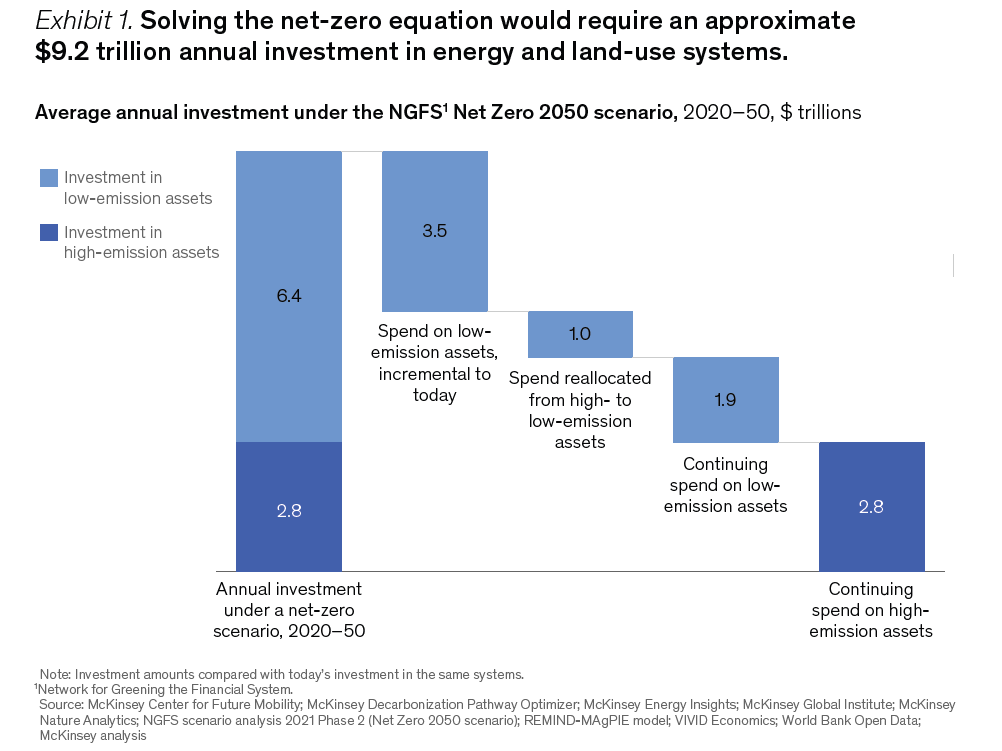

The transition to a net-zero global economy by 2050 requires a staggering $275 trillion investment in physical assets. This transition requires significant investment in clean energy, electric vehicles, decarbonisation of buildings and support for emerging markets and developing economies (EMDEs).

During this critical period, private financial institutions may be able to provide up to $3.5 trillion in financing per year between 2022 and 2050. This includes $2.0-2.6 trillion potentially offered by commercial banks and a further $950-1.5 trillion from asset managers, private equity and venture capital funds.

However, this opportunity comes with its own set of challenges.

Financial institutions must adapt to evolving regulatory frameworks that are essential to shaping the transition. It will be essential to align incentives with optimal pathways, such as financing emissions reductions.

Data quality, analytical tools and industry climate capabilities are inconsistent and often lacking.

Improving these capabilities will be necessary to make informed decisions.

Deploying capital requires a collaborative effort between all stakeholders. Fiscal and regulatory tools and financial risk-sharing mechanisms, such as blended finance, need to be put in place.

Financial institutions need to strengthen their internal capabilities to support their customers’ transition, finance green technologies and early retirement of high-emitting assets. Setting net-zero targets and timetables is a crucial first step.

Effective engagement with customers over time is essential. This may require rethinking relationship manager workflows and coverage models to better align with customer needs.

Decision-makers need to establish specific governance frameworks to oversee initiatives and align incentives with strategic objectives. It is essential to cultivate a decarbonisation culture within organisations.

The transition to a net-zero economy is both a challenge and a major opportunity for financial institutions. They need to adapt to changing regulations, improve their data and analytical skills, foster cooperation between stakeholders and develop their internal capabilities. By meeting these challenges and seizing the opportunities, financial institutions can play a leading role in financing the transition to a net-zero economy, thereby contributing to a greener global economy for future generations.