Near the end of 2023, whispers of declining electric vehicle (EV) sales, or at least slowing growth, began to circulate.

Jim Farley, Ford’s CEO, was among the first industry leaders to raise this issue, leading Ford to adjust its EV plans to a more conservative trajectory.

This seemed peculiar at the time, considering Ford’s EVs had a strong fourth quarter.

Surprising Sales Figures

However, it appears Farley’s assessment was inaccurate. Ford’s EV sales surged by 61% in the second quarter compared to the same period in 2023. The first half of 2024 witnessed a remarkable 72% increase in Ford EV sales overall, demonstrating exceptionally strong growth even without new model introductions.

Which other segment of Ford’s business has experienced such impressive growth? What potential lies in introducing electric vehicles in more model segments? Notably, Ford trails only Tesla in US EV sales, with 23,957 sales in the second quarter and 44,180 in the first half of the year. Ford’s focus on electric cars and trucks is proving to be a rapidly expanding and successful part of its business.

Conflicting Messages

The Ford Maverick, highlighted in a dedicated graphic in the news release, experienced 38% growth. However, this seems to overshadow the impressive performance of EVs.

Furthermore, these EV sales are predominantly “conquest sales,” the most valuable kind for automakers as they attract buyers from other brands. “Mustang Mach-E and F-150 Lightning are drawing customers from other brands; 62 percent of F-150 Lightning and 54 percent of Mustang Mach-E sales are new to Ford,” the company states. Yet, the visual focus remains on the Maverick’s conquest sales.

Model-Specific Highlights

- Mustang Mach-E sales increased by 46% compared to last year and are up 58% in the first half, representing the model’s best performance since launch.

- The F-150 Lightning, America’s top-selling electric truck, achieved 15,645 sales through June this year, with Q2 sales totaling 7,902, a 77% increase year-over-year.

- The Ford E-Transit was America’s best-selling electric van in the first half of 2024, with 6,301 sales, more than double the amount sold in the same period in 2023.

- Three out of four E-Transit sales this year are from repeat customers, drawn by the lower maintenance and fuel costs of electric vehicles.

Questioning Ford’s EV Strategy

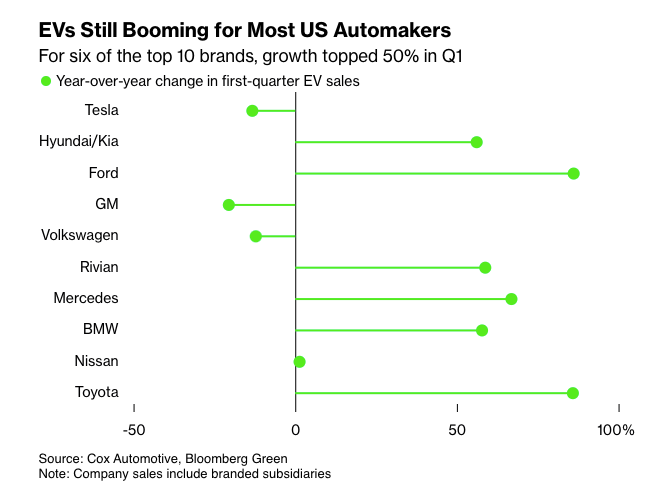

These figures raise questions about Jim Farley’s earlier claims of insufficient EV sales growth and the decision to scale back EV plans. Even among other automakers’ rapid EV sales growth, Ford stands out.

Notably, Ford recently removed the requirement for dealers to install certain EV charging and servicing equipment to sell EVs. While this move aims to expand EV sales across the dealership network, its long-term impact remains to be seen.

Contradictory Visions

In recent remarks, Ford CEO Jim Farley and GM CEO Mary Barra presented conflicting visions for the future of electrified vehicles. Both companies have been scaling back their battery electric car plans amid claims of a slowdown in consumer interest. However, Ford’s pure electric vehicle sales are growing faster than hybrids, contradicting Farley’s push for conventional hybrids.

The reasons behind Ford’s decisions remain unclear. It could be due to the Tesla Cybertruck outselling the F-150 Lightning, although Farley has historically been comfortable being second to Tesla. Perhaps the post-COVID sales boom inflated expectations, or maybe lower prices and insufficient economies of scale are affecting profit margins.

The Future of Ford’s EV Strategy

Regardless of the underlying reasons, Ford’s EV sales figures challenge the narrative of declining demand. The focus on conventional hybrids over pure electric vehicles seems misaligned with market trends. The future of Ford’s EV strategy remains uncertain, but the data suggests a strong potential for continued growth in the electric vehicle market.