Despite a rising levelized cost of energy (LCOE) environment, as highlighted in Lazard’s latest analysis, sizeable, well-capitalized companies with strong balance sheets are poised to continue leading the expansion of renewable energy assets.

Their ability to leverage economies of scale and withstand macroeconomic fluctuations positions them for success as the LCOE gradually declines.

Lazard’s 2024 LCOE+ Report: Insights into Renewable Energy Costs

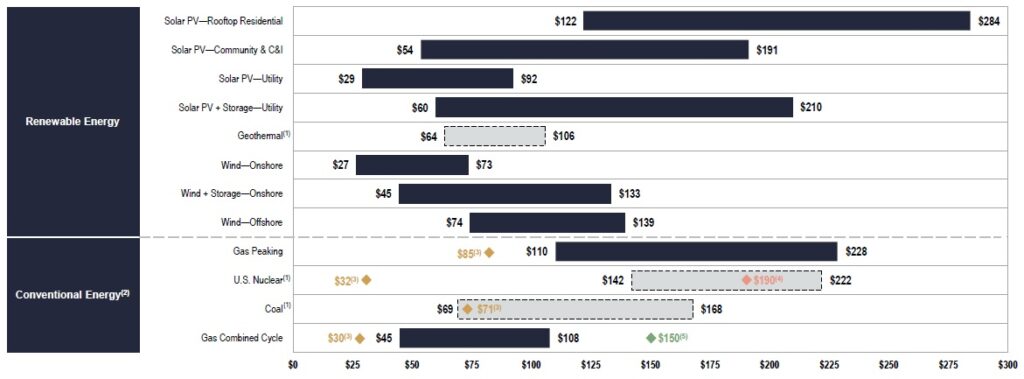

Lazard’s 2024 LCOE+ report, based on US figures and projects, offers a comprehensive view of renewable energy costs.

It reveals that even with the overall downward trend in project costs, specific renewable technologies remain competitive.

The report examines the LCOE of energy projects, energy storage, and hydrogen, emphasizing the growing value and widespread adoption of energy storage systems.

Key Takeaways: Stable LCOE Averages, Tighter Ranges

Key findings from the report indicate that the lower end of LCOE values for renewable energy has increased, while the overall ranges have narrowed.

This leads to relatively stable LCOE averages year-over-year. These trends highlight the need for diversified generation fleets to meet future baseload power demands and emphasize the crucial role of innovation in the energy transition.

Rising Power Demand and the Need for Diverse Energy Resources

The report underscores that growing global power demand, driven by factors like artificial intelligence, data centers, reindustrialization, onshoring, and electrification, accentuates the need for a diverse energy mix.

As intermittent renewable energy sources become more prevalent, the gap between peak demand and renewable energy production widens.

Energy Storage and Combined Cycle Gas Turbines as Complementary Solutions

Lazard suggests that complementing new renewable technologies with energy storage or existing/new dispatchable generation, such as combined cycle gas turbines, is the optimal approach to address the challenges of intermittent energy production.

Have You Read?

High Capital Costs Hinder Clean Energy Investment in Africa

This recommendation is supported by their marginal cost analysis, which reveals the increasing price competitiveness of existing gas-fired generation compared to new renewable energy projects.

Innovation and Collaboration: Key Drivers of the Energy Transition

Lazard emphasizes that continuous innovation across technology, capital formation, and policy is essential for a successful energy transition.

This transition encompasses a diverse and advanced generation mix capable of meeting the evolving needs of the energy economy.

It also requires the maturation of technologies not covered in the analysis, such as carbon capture, long-duration energy storage, new nuclear, and more.

Energy Storage Costs: Declining Lower End, Wider Range

The report’s analysis of the levelized cost of storage (LCOS) shows a slight decline at the lower end but a more pronounced increase at the higher end. This results in a wider range of LCOS outcomes across the operational parameters studied.

Factors influencing these trends include declining battery cell prices due to increased manufacturing capacity and lower mineral costs, offset by a notable rise in EPC pricing driven by high demand, timeline scrutiny, labor shortages, and wage requirements.

Growing Importance and Adoption of Energy Storage Systems

Lazard’s LCOS analysis reinforces the increasing value, understanding, and adoption of energy storage systems.

Grid operators are developing methodologies to value these resources, leading to increased transaction activity and infrastructure classification for energy storage assets.

The US Inflation Reduction Act’s Investment Tax Credit eligibility further supports the stability of LCOS values.

The report acknowledges hydrogen’s potential role in addressing hard-to-abate industrial processes but notes that the cost of equipment (like electrolyzers) and the source of electricity (green, pink, etc.) significantly impact the levelized cost of hydrogen production.

Find out more in Lazard’s LCOE+ report