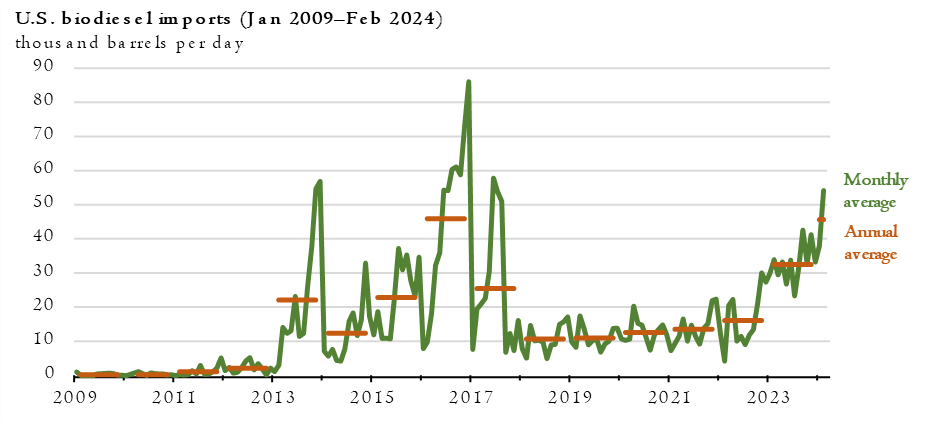

According to the latest available data, annual U.S. biodiesel imports doubled from 2022 to 2023, reaching 33,000 barrels per day (b/d), and continued to rise in the initial months of 2024.

The majority of this increase originated from Germany, with additional imports primarily from other European regions where an excess supply of biodiesel has led to reduced prices.

Historical U.S. Biodiesel Imports

Prior to this recent surge, U.S. biodiesel imports, a fuel commonly blended with petroleum diesel or heating oil, averaged 12,000 b/d from September 2017 through October 2022.

Impact of the Renewable Fuel Standards Program

The U.S. Renewable Fuel Standards (RFS) program, enacted in 2005, has significantly driven the demand for biodiesel. In its early stages, the required blend volumes for renewable fuels were minimal, resulting in low import levels. As the program has matured, the blending requirements for biofuels such as biodiesel have progressively increased, leading to higher consumption, imports, and domestic production.

From 2013 to 2017, annual U.S. biodiesel imports rose to 27,000 b/d, largely due to subsidized biodiesel from Argentina and Indonesia. In response to these subsidies and the consequent increase in imports, the U.S. Department of Commerce and the International Trade Commission initiated trade investigations in April 2017. These investigations culminated in antidumping and countervailing duty orders, imposing tariffs on biodiesel imports from these countries to offset the subsidies. Given that imports from Argentina and Indonesia accounted for nearly 75% of U.S. biodiesel imports during this period, these measures significantly reduced import volumes.

Recent Trends in U.S. Biodiesel Imports

The recent escalation in U.S. biodiesel imports began in November 2022, with imports reaching 30,000 b/d. This upward trend continued in 2023, with imports hitting 33,000 b/d and further increasing in 2024. In February 2024, the United States imported 54,000 b/d of biodiesel, marking the highest monthly total since June 2017.

Factors Driving Increased Biodiesel Imports

The primary driver of the recent increase in U.S. biodiesel imports is the low biodiesel prices in Europe, which have made imports economically attractive. These low prices result from policies under the EU Renewable Energy Directive, which establishes renewable energy targets.

The updated Renewable Energy Directive (RED II) caps the biofuel portion of the European renewable energy target in transport at 7%, with individual EU member states implementing their own regulations. Many states permit advanced biofuels, defined by the EU as those produced from used cooking oil or other specified feedstocks, to count twice toward blending targets.

Several factors have contributed to the reduction in biodiesel prices in Europe:

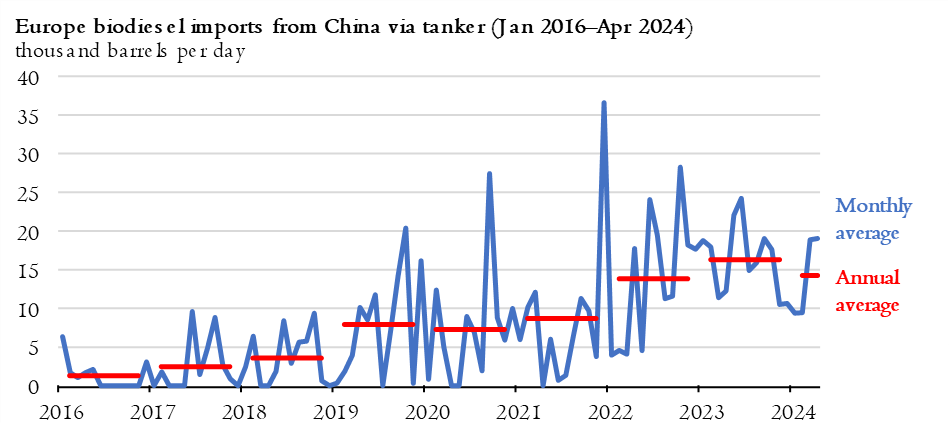

- Increased biodiesel imports into the EU from China, a shift towards greater consumption of renewable diesel instead of biodiesel to meet EU blending targets, and lower overall biofuel targets.

- Due to RED II and the regulatory programs of EU member states not distinguishing between renewable diesel and biodiesel, renewable diesel can replace biodiesel to meet blending targets. Renewable diesel is entirely interchangeable with petroleum diesel and can be blended in any proportion, unlike biodiesel. This flexibility has driven production growth recently, pushing many EU countries close to the 7% overall biofuel limit set by the EU.

- Several EU member states have reduced biofuel targets in response to high inflation. The most significant reduction occurred in Sweden, which previously had more ambitious targets than required by the EU. In 2023, Sweden announced a reduction in the required biofuel proportion in diesel from 30.5% to 6.0% for the period 2024-2026. Additionally, other EU member states have taken measures to decrease biodiesel consumption and needs.

As biofuel margins have tightened in Europe, some producers have turned to the U.S. market for higher prices. Biodiesel imports to the United States began rising in late 2022 as compliance credit prices, known as renewable identification numbers (RINs), approached record levels and European biodiesel prices declined. Although RIN prices have dropped to three-year lows in 2024, the increased biodiesel flow from Europe to the United States continues, indicating a price premium for U.S. biodiesel over European biodiesel.

Sources of Increased U.S. Imports

The significant rise in U.S. biodiesel imports primarily came from Germany. From 2022 to 2023, U.S. biodiesel imports from Germany more than doubled to 11,000 b/d, making it the largest source. Additional increases came from Spain, Italy, and Belgium, with smaller increments from South Korea and Brazil.

The distribution of U.S. biodiesel imports reflects the production capacity in these countries. Germany, a leading biodiesel producer in Europe, significantly contributes to U.S. imports. Spain, Italy, and Belgium are also key biodiesel producers and exporters.

Moreover, the geographic footprint of biofuel companies capitalizing on arbitrage opportunities shapes U.S. biodiesel imports. Archer-Daniels-Midland (ADM), an international agricultural processing and commodity trading company with biodiesel plants in Germany, Canada, Brazil, and the U.S., has been the primary importer since November 2022. ADM’s export terminal in Hamburg, Germany, connected to its oilseed processing plant—the largest in Europe—has been the source of all U.S. biodiesel imports from Germany since 2022, according to Vortexa tanker tracking data.

Impact on U.S. Biodiesel Production and Consumption

Despite rising imports and competition from renewable diesel, U.S. biodiesel production increased by 5% in 2023 compared to 2022. Consequently, in 2023, the U.S. consumed the most biodiesel since 2017.

However, forecasts indicate a decline in U.S. biodiesel production in 2024 due to anticipated lower blend margins driven primarily by decreasing RIN prices. Increased renewable diesel production, which is expected to continue driving down RIN prices and blend margins, along with high biodiesel imports, contributes to this projection.

Annual Biodiesel Consumption and Net Imports

“Although we do not provide a specific forecast for biodiesel imports, we project net biodiesel imports (imports minus exports) for the United States. We estimate that net biodiesel imports in 2024 will be similar to 2023 levels, attributed to high early-year imports and sustained reduced demand in Europe. Nevertheless, we expect net imports to stabilize as the year progresses, driven by the increasing domestic supply of renewable diesel.” concluded the U.S. Energy Information Administration.