The planet is experiencing unprecedented fires, droughts, floods and other more frequent extreme weather events. These threats are rapidly intensifying as the world continues to warm.

To Avoid a dramatic global tipping point, Public and Private sectors are involved on achieving the goals of the Paris Agreement. Both adapting to climate change and limiting global warming.

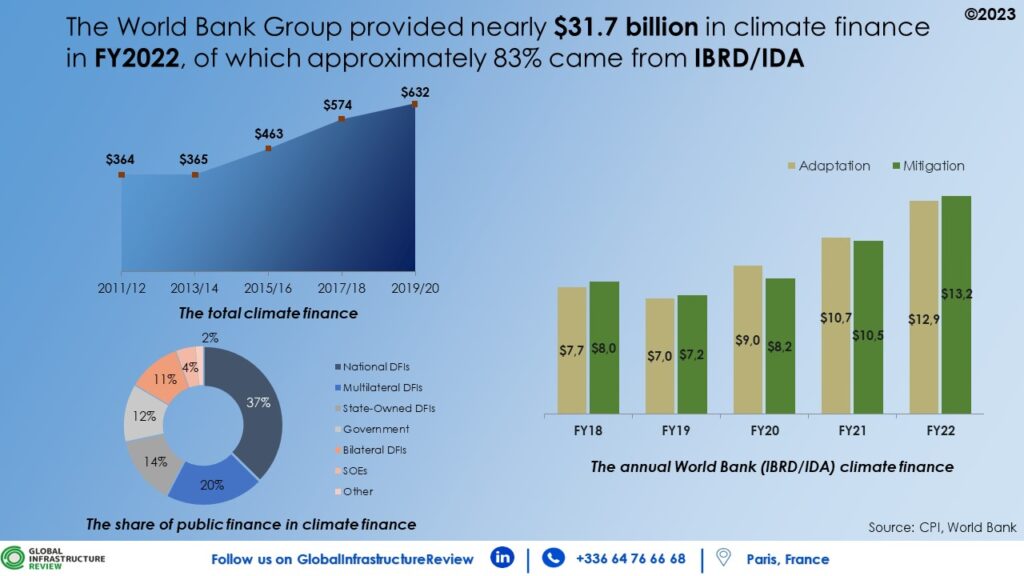

Indeed, of the average $632 billion of climate finance tracked by the CPI in 2019/2020, the public sector accounted for 51% ($321 billion), with development finance institutions (DFIs) being the main provider of public finance at nearly 70%. Among the DFIs, the World Bank Group stands out, committing €104.4 billion in FY2022 in the regions where it operates, with the bulk of the financing in SSA and LAC regions.

However, it is worth noting that climate change is central to the strategy of the Bretton Woods institution as the bank is the largest multilateral funder of climate investments in developing countries.

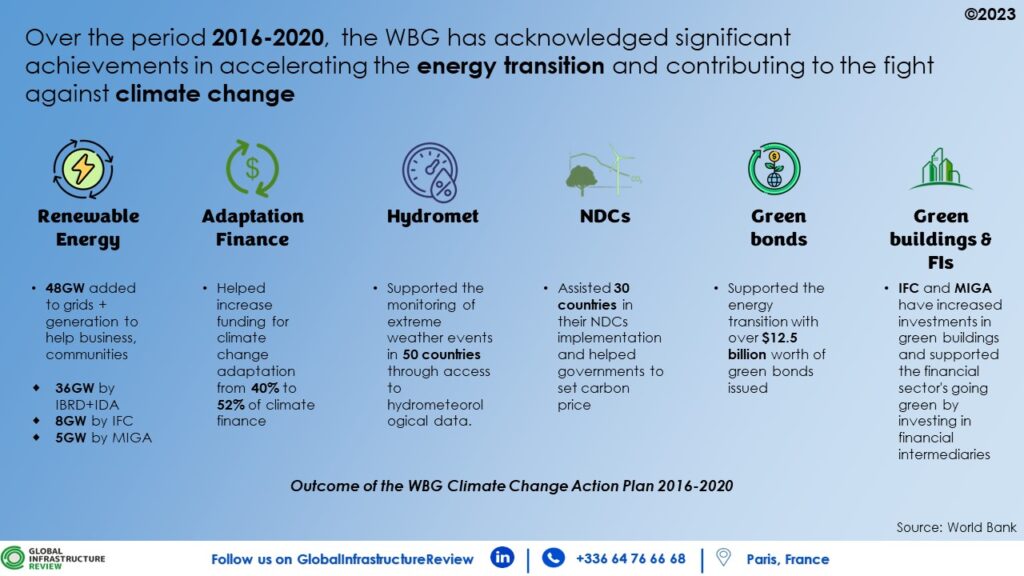

WBG took some initiatives to address climate change as outlined below.

– The World Bank group launched its second Climate Change Action Plan (CCAP 2021-2025), with an ambitious target to make sure that at least 35% of bank financing is to be for climate financing. In FY 2022, the bank has delivered close to 31.7$ billion in climate financing, which actually exceeded the 35% (of $104.4 billion) ambitious target.

– The World bank have introduced in 2021 the climate change development report (CCDRs) to help countries integrate development and climate considerations. The CCDRs actually help the bank to identify policy reforms and priorities in projects pipelines.

– The Bank has developed the Climate Toolkit for PPPs, launched in 2022, to serve as a screen for climate risks and opportunities and to help client governments, practitioners and the private sector integrate climate mitigation and adaptation requirements into infrastructure projects.

– As part of the World Bank Group’s interventions to help enable and scale up private capital mobilisation, the bank is working at supporting countries in enabling the asset policy reforms, building the regulatory frameworks, developing the bankable project pipelines, and providing the necessary derisking and innovative financing, in particular climate finance.

Tackling the challenge of climate change is one of the issues of our time and the World Bank Group believes that PPPs will be an important category that will provide solutions to the private sector and help close the climate finance gap.